Earnings Before Interest, Taxes, Depreciation, and Amortisation (EBITDA) is a widely used financial metric in business and investing circles. It offers an insight into a company’s operating performance by focusing on the earnings generated from its core business activities. This article, crafted in British English, aims to demystify EBITDA, illustrating its importance, how it’s calculated, and its role in evaluating business health and performance.

Understanding EBITDA

1. Definition:

- What is EBITDA? EBITDA is a measure of a company’s overall financial performance. It calculates the earnings before the deduction of interest expenses, taxes, depreciation, and amortisation. This metric helps in comparing the profitability of different companies and industries by eliminating the effects of financing and accounting decisions.

2. Importance in Financial Analysis:

- Profitability Assessment: EBITDA provides a clear view of profitability from core business operations, excluding the influence of financial and accounting decisions.

- Investment Comparisons: It allows investors to compare companies with different capital structures and tax situations on a more level playing field.

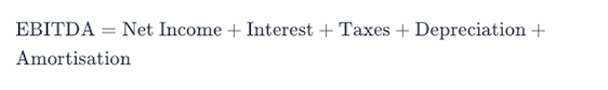

3. Calculating EBITDA:

- The Formula: The basic formula for EBITDA is:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortisation

- Components Explained:

- Net Income: The company’s total earnings or profit.

- Interest and Taxes: These are added back to the net income because EBITDA focuses on operational performance.

- Depreciation and Amortisation: Non-cash expenses related to the depreciation of assets and amortisation of intangible assets.

4. EBITDA in Business Valuation:

- Assessing Operational Efficiency: EBITDA is often used to assess a company’s operational efficiency without the impact of financial and accounting decisions.

- Valuation Tool: It is a key metric in business valuation, often used in determining the enterprise value of a company.

5. Limitations of EBITDA:

- Not a Cash Flow Indicator: EBITDA doesn’t account for cash flow or capital expenditures.

- Can Mask Financial Health: Overemphasis on EBITDA can mask issues like high debt levels or significant capital expenditure requirements.

6. EBITDA in Different Sectors:

- Varied Significance: EBITDA’s relevance can vary significantly across different industries. It is particularly useful in capital-intensive industries where depreciation and amortisation are significant factors.

Conclusion: The Utility and Caution of EBITDA

In the realm of financial analysis and business evaluation, EBITDA serves as a valuable tool, offering a snapshot of a company’s operating profitability. However, it’s crucial for businesses and investors alike to understand its limitations, particularly in the context of cash flow and capital expenditures. EBITDA should be used in conjunction with other financial metrics to gain a comprehensive view of a company’s financial health and prospects. By doing so, businesses can make more informed decisions and investors can better assess potential investment opportunities.

Businesses don't need likes, views, or followers – what truly matters are customers. Be a leader, not a hunter: Build a business where customers find you.